I have been wanting to write this post for a while but just wasn't feeling inspired to do it. I do want it recorded for my memory's sake and also hope that maybe it will inspire someone that might stumble across my teensy tiny blog. So here goes.....

Michael and I live debt-free. As in we owe only for our home. As in we pay our utilities and other monthly expenses and the rest of our money is ours to do with it as we please. I am not bragging (well maybe a little) but sometimes I need to remind myself how VERY far we have come. It was HARD WORK I tell ya.....very hard....but SOOOO worth it!

Every person's story to becoming debt-free is different based on how much debt they started with. I will say that Michael and I were extremely blessed to start out with a small amount of debt compared to other people out there. When we got married I had zero debt coming into the marriage (and zero credit mind you). This is because my lovely parents had bought me a newer, used car when I was in high school and I was still driving it. I never got into credit cards either (thank God!). Also my college education to that point was completely paid for either through scholarships or my current workplace. I worked for an extremely benevolent man that offered to pay for my schooling if I continued to work there. Yes please! So anyways I was 21 when we married and had no debt. Even our wedding was paid for by myself and my parents.

Michael on the other hand had all the debt coming into marriage. I didn't even realize how much he had. He had one credit card, a new truck payment (upside down in it), a motorcycle (Harley-Davidson) payment, and I think another small car payment. I can't really remember but I know his payments all added up to half of his monthly income. He did not have good credit due to a bad deal (before I met him) with a four-wheeler loan. He even had a really hard time getting approved for a cell phone! His credit got a little better as we bought some furniture on credit while we were engaged and we both worked at paying it off before we were actually married.

So we were married and living in bliss....at least that's what I thought. I worked part-time and went to school full-time for the 1st two years of our marriage. We lived rent-free next door to my parent's in a single-wide trailer they owned and used to rent out. I thought we had all the money in the world. Little did I know that my husband was crumbling and afraid to tell me how bad things were getting.

We each had our own checking accounts when we married and we had decided that to keep things simple we would just leave it that way. I kept up with "my" money and Michael kept us with "his." I was expected to take care of the groceries and my gas and Michael paid all the bills with his check since my pay would fluctuate based on how much I got to work that month. So I continued spending much the way I had when we were dating/engaged. I would buy little things I wanted with no budget in mind and then sometimes I would realize I didn't have enough money to buy gas to go to work/school. So I thought "no problem" I will just ask Michael for some money. But I didn't know that he didn't have any to give me.

I just could not figure out why Michael was sooo moody on pay days instead of being happy about getting paid. I was happy to have another gush of money to spend on whatever my heart desired (mind you I've always been a bargain shopper and like to make stuff rather than buy stuff). So I wasn't spending insane amounts of money but I just wasn't spending with any real thought. Also, I need to mention that we had just bought an 11 acre lot and financed it with a mortgage and even had to finance the closing costs, etc.

It all came to head after our second Christmas together. In fact Dave Ramsey himself is what saved us. I truly believe it was a God thing. I had found this interesting looking audio book at the library. I had just gotten into listening to audio books on my 45 minute rides to work/school each day. So I thought what does it hurt to hear what this bald-headed man claiming to help you become debt-free had to say. I popped the CD in on my way home one night and I just knew my life was about to change in a major way! I so wanted Michael to be happy and I was worried about how upset he seemed to get around payday. I was beginning to realize that our money situation was not what it could be. Why did we not have more extra money when we didn't even have to pay rent?!!

So I listened to the whole CD/book in a couple of days and I knew Michael HAD to listen to it too and not just go off what I said. I just asked him to listen to it and see what he thought about it. I didn't start in on preaching it to him until he had listened to it first. To my surprise he did and he was as excited about it as I was!! But that's when the truth finally came out....and it was not easy to swallow.....

We were in more debt that I realized. Michael had a debt that I had no idea about. I knew about all the others but I didn't know that he had taken out a personal loan (at a less than stellar financial institute) to help cover the cost of Christmas!!! I knew we were cutting it close to paying for all the gifts and then Michael had given me some extra to use (that I thought was from his account). See I told you were were no where on the same page with money! So naturally I was upset....furious.....hurt.....and feeling guilty......he was just trying to protect me and not make me worry and make everything OK. He felt terrible too but I think just getting the truth out and realizing that we were in this together from now on took a huge weight off of him. So then we had to decide where we went from there.....rock bottom.

We added up the debts (smallest to largest), cashed in his small and old retirement account, and started tackling our debt. We had our $1,000 emergency fund in no time thanks to the cashed in account and then we put the rest on that personal loan to get it out of our life first thing!! We struggled a lot with paying off the debts until I finally graduated and started working full-time. Then things started rolling better. We cut out a lot of extra spending that we did. We didn't go out to eat very much at all, we watched just the basic channels on TV and we of course had basic cell phone service. We drove our same old cars and just saved! Here is a basic list of what we did.

1. Cashed in Michael's retirement account from his former job to get our ER fund funded and pay off the personal loan and part of a credit card that had a small balance.

2. Sold the Harley (tear)! That was a hard one but when you are paying more for something than you are supposed to get enjoyment out of it....it's no longer fun.

3. Sold Michael's truck (to Car Max) at a loss and took out a smaller loan for the difference. Then paid off the small loan. That was a hard one b/c Michael had never sold something and "lost" money and that's when some of our relatives really thought we had lost it!

4. Bought a beater Honda Civic for Michael to drive everyday....talk about saving gas!

5. Worked really hard and paid off the small personal loan we took out on our land that had a high interest rate/balloon payment plan.

So at this point all we owed for was our land (remember we didn't have a mortgage) and we were loving it. We still only had the small ER fund but we thought we were rich at this point. Here is where we veered off Dave's path a little (and came to regret it later). We (me) decided we wanted to buy a house instead of wait and build on our little piece of land. I was so sick of living in that trailer (5 years) and saw no end in sight and I had vowed we would not bring a child home to that tiny place! So buy a house we did!

Then we made a big no-no and bought a newer vehicle on credit rather than saving up......cue the duh, duh, duh....

Well we learned from that mistake too and worked our butts off to pay the thing off and in the middle of that we sold our little piece of land that we had fallen out of love with (for a small profit) and banked that money to beef up our ER fund.

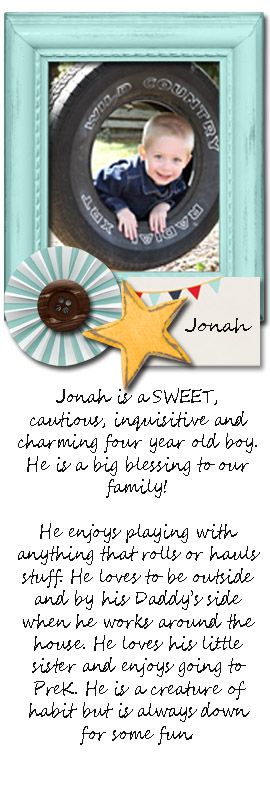

So that is our long story of how we got where we are today and how we learned to live on less than we make. We are so blessed that God put Dave Ramsey's plan into our path when he did and that hopefully Jonah will benefit from our mistakes that were made before he came along.

The last thing I will add is that while we went through this whole process we never stopped GIVING...in fact we gave more money than we each ever had in our adult lives. And God blessed us right back every time we thought things were going to get bad. Going through the process and actually seeing the blessing appear right in front of us is what kept us going. God is so good and so faithful to provide when you are going in a direction that he likes.

For more information on how to start your own Total Money Makeover click here.

Style Showcase 334

2 days ago

No comments:

Post a Comment

I love comments!